Is Silver Still Following Gold?

Everybody has mainly been watching gold since it's at an all-time high. While it's been in the spotlight, silver seems to have largely become an afterthought. Silver typically follows what gold does in terms of price, but I don't think it's been doing that as much lately.

Why does this even matter? While gold is at all-time highs, silver has gone up in price as well. It's certainly not cheap, but if you're looking to buy metals, you should always be looking to preserve your wealth at the lowest cost per ounce possible. Sometimes, that means switching up which metal you're buying. Maybe it's time to switch it up and focus heavier on silver? Let's look.

These are just patterns I'm noticing. I'm by no means a financial expert whatsoever, so draw your own conclusions from this data.

5-year trend for gold vs. silver

Source: Kitco app

Source: Kitco app

(Source)

(Source)

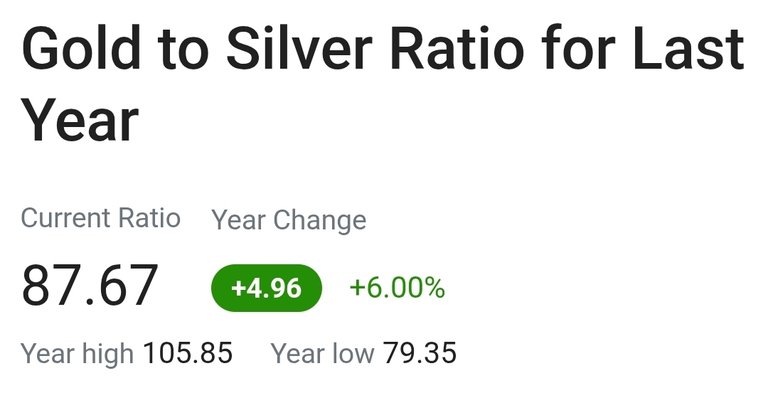

We're used to seeing a gold to silver ratio of around 100:1 in recent years, which means about 100 ounces of silver equates to 1 ounce of gold in terms of the cost to purchase in dollars.

1-year trend for gold vs. silver

Source: Kitco app

Source: Kitco app

(Source)

(Source)

We see a slower climb for silver, while gold initially took off faster. Here, recently, however, we see gold trading flat and silver continuing an upward trend. Notice the lowest silver to gold ratio is higher here compared to the 5 year low. That could indicate silver price has room to fall, but let's see what the trend is here shorter term.

6-month trend for gold vs. silver

Source: Kitco app

Source: Kitco app

(Source)

(Source)

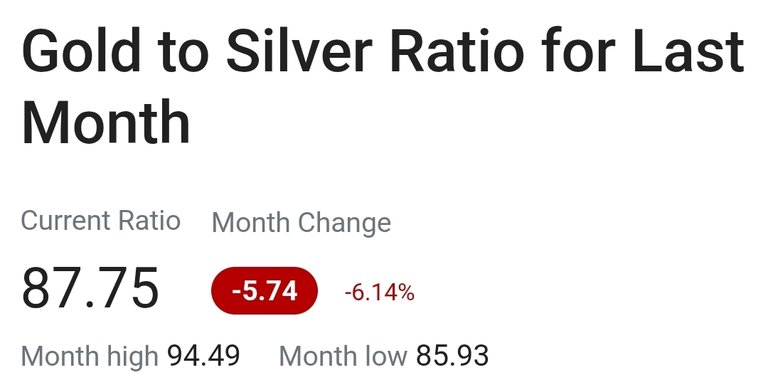

Here, we see the price of gold remaining relatively flat. By contrast, silver appears to be continuing its uptrend. The silver to gold ratio barely increased during this time.

30-day trend for gold vs. silver

Source: Kitco app

Source: Kitco app

(Source)

(Source)

Gold is still trading flat, while silver saw about a $1.50/ounce increase in price in just this short timeframe. The trends seem to indicate silver is still currently following gold's rise in price. Many say that the price of silver lags behind gold, so perhaps silver is just catching up. If we see the uptrend in silver price continue while gold continues to trade flat, we may see that gold to silver ratio decrease further.

At this point, I think it's too hard to say what will happen just yet. I think that, to some extent, silver could continue to gain and possibly break the $40/ounce barrier if gold at least continues to trend sideways over the next few months. If gold were to drop in price, I think we'd likely see a correction in silver pricing while people try to take advantage of a drop in gold prices.

There's no way to predict what will happen since we haven't seen gold prices this high before. It's also been a while since silver prices have been this high. Personally, I wouldn't mind a drop in the price of either metal as a nice buying opportunity, but between the two, I'd prefer a drop in the price of silver more than anything.

Buy DUO and stake to receive Hive dividends, tip others, have your posts curated, and grow Hive!

https://tribaldex.com/trade/DUO

https://hive-engine.com/trade/DUO

Do you like stacking gold and silver?

Are you new to Hive, or know someone new to Hive, and want help and support?

Have you been on Hive for a while and want to help new Hive members? Join HOC and help us grow Hive and encourage new members!

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

Both my Gold and silver stacks are set. Any further stacking is just icing on the cake for fun, family and friends. We don't know when, but it will came.

Stacking popcorn.

!BBH

!HUG

Hello bulliontools!

It's nice to let you know that your article will take 10th place.

Your post is among 15 Best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by gwajnberg

You receive 🎖 0.5 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 733 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq

STOPor to resume write a wordSTART