TGLD: Ponzi within A Ponzi?

I don't like to trash talk other tokens or projects, but when I see something concerning I have to speak up. There has been a lot of hype about TGLD. While hype isn't a bad thing, I have quite a number of concerns with the fundamentals.

The idea of TGLD is that it's a tokenized "Real World Asset" pegged to GLD. I have multiple problems with this, so let's break it all down one step at time and see if TGLD is on the level or if it's a Ponzi.

(Created with Bing)

(Created with Bing)

What Is GLD?

GLD is an ETF, or Exhange Traded Fund. It is designed to give people a way to have exposure to the gold market without owning physical gold. There are fees charged for managing the fund, which is how it brings in revenue. While the shares state they are backed by physical gold held in vaults by banks, you have no claim to it. You can't turn your shares in exchange for any of the gold. So, there are no real assets here, either in TGLD or GLD.

(Source)

(Source)

For many of us who are stackers, GLD is a waste of time. I'd rather own physical gold.

What Is TGLD?

TGLD is another crypto token. This claims to be pegged to the price of GLD at a ratio of 1:100. This means the cost is significantly lower than buying a share of GLD.

The big difference here is that Leo is promising a yield, which GLD does not offer. That sounds great at first, but where is this yield coming from? Let's look at it in Leo's own words, point by point.

(Source)

(Source)

Their first claim is they are making capital from making new markets. Think about that. Capital is not revenue. Those are funds raised from investors. If the market fails, they will likely ditch it and create a new one, hoping people will buy it. Leo has a reputation for repeatedly doing this.

Future products - So this isn't something that exists yet and sounds like it will rely on buy-in from Hive users before it can generate income. These could be legitimate, but also has Ponzi vibes of paying older "investors" with money coming in from new "investors."

Collateralized lending - While this has the potential to make money, it doesn't exist yet. It's as good as an empty promise.

lstr.voter - This is just a percentage of curation rewards being shared with token holders. I can get 100% of this delegating my HP to @ecency and it costs me nothing.

LeoDex sLEO staking yields - While this is great, LeoDex isn't even in the top 200 decentralized exchanges according to CoinGecko. This means the only way you're getting rewards from this is from them staking their LEO. Many things can affect this, such as the price of LEO, USDC, a bear market, etc. If it were from fees from being in the top 100 of exchangess that would be more reassuring, but that's not the case. (Source)

Lots of "Ifs"

The only thing guaranteed here are curation rewards. There's no guarantee the other sources of income will materialize. The LeoDex rewards seem like they will come in regularly, but there is room for a lot of fluctuation in the rewards themselves. Collateralized lending may or may not materialize. If it does, that could be a good source of income, but it's all dependent on demand and having a system in place to avoid a large number of people defaulting on bad loans.

Ponzi within A Ponzi?

The idea of a Ponzi scheme is the older "investors" are paid with the income from selling to newer "investors." If you get in early and sell, you'll likely make a profit. As the project matures and the stream of new "investors" slows down and dries up, the only incoming revenues are the streams mentioned previously. Only two of those are viable right now, with the future two theoretical sources of income being dubious at best.

Let's also look at the track record of what Leo builds. Much of it doesn't work. Threads still don't work reliably. CUB was a failure. Polyvex resulted in countless stolen HBD, with investors being "paid back" with LEO that was printed out of thin air, which was worth at best half of what people paid into it. This then added a ridiculous amount of inflation and devalued the token further.

I like the idea of TGLD. I don't like the proposed revenue sources. I really don't like the track record of Leo. It claims to be a RWA (Real World Asset) but you can't actually call it an asset when it's not backed by assets. There are too many red flags and warning signs for me here, so I'm out.

Buy DUO and stake to receive Hive dividends, tip others, have your posts curated, and grow Hive!

https://tribaldex.com/trade/DUO

https://hive-engine.com/trade/DUO

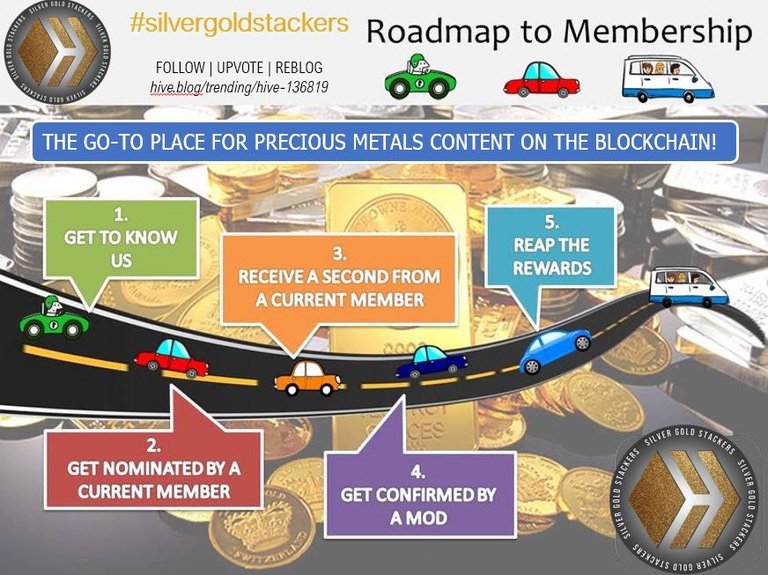

Do you like stacking gold and silver?

Are you new to Hive, or know someone new to Hive, and want help and support?

Have you been on Hive for a while and want to help new Hive members? Join HOC and help us grow Hive and encourage new members!

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

reblogged

!BBH

!UNI

!LOLZ

!ALIVE

Thank you!

!LUV

!BBH

!PIZZA

!DUO

You just got DUO from @bulliontools.

They have 1/1 DUO calls left.

Learn all about DUO here.

Thank you! 😁

!BBH

!PIMP

$PIZZA slices delivered:

bulliontools tipped sylmarill

definethedollar tipped bulliontools

bulliontools tipped gwajnberg

@bulliontools(1/5) tipped @melinda010100

bulliontools tipped daveks

bulliontools tipped bozz

Please vote for pizza.witness!

!PIZZA

!PIMP

!LOL

You can say that again!

!BBH

!PIZZA

Thanks for breaking it down. For me the chain of custody to the "real" world asset was never obvious or trustless ( or even verifiable from my perspective), so I didn't get a deep as your analysis , but my conclusion was the same.

Yeah, the problem is there is no asset. Nobody has a claim to a thing if it all becomes insolvent. The gold in GLD is real, but none of us can have it. There's nothing backing TGLD.

!BBH

!PIZZA

Good write up. I did throw a few hundred bucks into this idea. We always have to be aware of both pros and cons.

Thanks! If you get in early and time your exit, you'll probably be fine. I just don't see it being viable long-term.

!BBH

!PIZZA

On a side note. Silver wow!!

Right? I need it to go down so I can buy more, not less! 😭

I picked up a couple of tokens fairly early. I will just wait and see if I get anything from the drips or whatever it is.

If you're not in it for much, then it's probably not a big deal either way. It's jist not something someone would want to go all-in on. I don't see it being viable long-term.

!BBH

!PIZZA

Almost missed that 😬 i agree 100%!! I dont go often with tokenized gold but if i was going there there are other projects that are totally backed by gold better than this one!

Yeah, this one is an easy skip. It's basically fairy dust. !LOL

!BBH

!PIZZA

!ALIVE

Thanks for this. I bought a couple without realizing it was Leo. I'm out.

No problem. If Leo didn't have such a bad history and reputation I'd consider getting it myself even though it's not physical gold.

!BBH

!PIZZA

!ALIVE