Silver Premium Discrepancy Ripe for Arbitrage?

The massive rise in silver spot price over the last few months has caused quite a bit of chaos in the futures markets. It's at a level we haven't seen before, so anything could happen at this point. It's an uncertain market with lots of variables in play all at once.

The biggest variable in play right now is the premium discrepancy. In the West, we have the COMEX in the US and the LBMA in London dictating prices for metals. In the East is the Shanghai Exchange. There's typically a small price discrepancy between the East and West markets, but it's typically small. The premium has increased these last few months, to the point that the Shanghai Exchange has anywhere from a $5-8 premium compared to the markets in the West.

(Source)

(Source)

In theory this leaves a window of opportunity for traders in the East to buy cheaper from the West than they can get locally.

(Created with Bing)

(Created with Bing)

I think this may lead us to see a see-saw effect in the West, as the East buys out silver from the US and London. Once either the COMEX or LBMA put a halt to this, I think we'll see more of a continuous increase in price. It's all in theory at least, since a conflict between the US and China, or any other interruption to silver supplies could introduce new variables that have the potential to cause a lot of price fluctuation. It's anyone's guess what will happen at this point, but it's clear we're seeing price discovery in the markets. It'll be interesting to see just how far silver price goes before we see a correction.

Buy DUO and stake to receive Hive dividends, tip others, have your posts curated, and grow Hive!

https://tribaldex.com/trade/DUO

https://hive-engine.com/trade/DUO

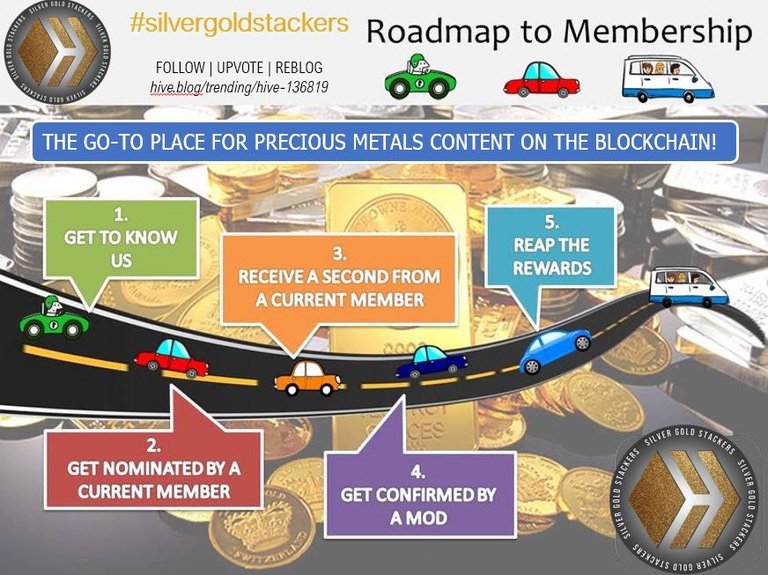

Do you like stacking gold and silver?

Are you new to Hive, or know someone new to Hive, and want help and support?

Have you been on Hive for a while and want to help new Hive members? Join HOC and help us grow Hive and encourage new members!

This is one time I wished I owned a C-130 Transport plane and rent it out to Metals Traders in New York at a nice fee. Arbitrage works only if there is a ready inventory of silver to get a hold of rather than another paper promise weeks later.

!PIMP

Right? You could make some good money that way.

I doubt most are taking delivery, but I wouldn't be surprised if there are a handful of big players taking advantage.

!BBH

!PIZZA

!ALIVE

I don't understand futures contracts in general. I saw a story the other day about that Kalshi platform and I just can't wrap my head around it.

It's basically gambling and guessing what prices will do short-term and long-term. Very few people can actually take delivery of the physical metals because of the price requirements, transportation, security, etc.

!BBH

!PIZZA

!ALIVE

$PIZZA slices delivered:

@itharagaian(4/20) tipped @bulliontools

bulliontools tipped kerrislravenhill

Learn more at https://hive.pizza.

!PIZZA

!ALIVE

Your post has been manually reviewed for curation by the Principality of Bastion.

Ithara Gaïan

Principality of Bastion - Our Leit Motiv? Uniti Crescimus.

Principality's site | Principality's Discord | Our Twitch Channel

You may TRAIL this account if you like the curation we do, or join our discord to know more about what we do.

If you like music, you may find me on : Apple Music / Spotify / Tidal / Deezer / Youtube Music / ...